When discussing the Aatmaj Healthcare Share Price Target 2025, it’s essential to first understand the fundamentals of this promising healthcare company. Aatmaj Healthcare focuses on innovative healthcare solutions, addressing critical needs within the medical sector. As the company continues to expand its services and reach, I believe the potential for strong share price growth in 2025 is significant. In this article, I promise to provide you with updated information on the share price targets for Aatmaj Healthcare, offering insights that could help you gauge the stock market’s pulse on this emerging player.

Looking ahead, I feel optimistic about the future of the healthcare sector, which has consistently shown resilience and adaptability in an ever-changing landscape. Factors like an aging population, technological advancements, and increased health awareness contribute to the growth trajectory of companies like Aatmaj Healthcare. In my opinion, the potential for substantial returns remains strong as we project share price targets for Aatmaj Healthcare not just for 2025, but also for 2026 through 2030. With over seven years of experience in the stock market since 2017, our insights aim to give you a clearer perspective on what to expect. Remember, while our information is designed to inform your research, it’s crucial to conduct your own due diligence before making any investment decisions.

Aatmaj Healthcare Share Price Target 2025

Here’s an easy-to-understand tabular summary of future estimates for Aatmaj Healthcare Share Price Target 2025. Here’s a look at price predictions for 2024, 2025, and beyond, covering 2026, 2027, 2028, 2029, 2030, 2035, 2040, and 2050.

This post on Aatmaj Healthcare Share Price Target was published on or after 14 December 2024, and the price forecasts were updated later to reflect the latest estimates.

Note: The above list is based on the prospects of strong fundamental performance by the companies and the prevailing bull market in Nifty and other global indices.

Aatmaj Healthcare Share Price Target Range Forecast Tomorrow, Next Week & Month & in 5 Years

In this section, we have given Aatmaj Healthcare Share Price Target estimates and price predictions for today, tomorrow, next week, Monday, next month, and even five years from now. Let’s break it down! Aatmaj Healthcare Share Price Target Tomorrow mostly depends on how Dow Futures today live and Sgx Nifty today live / Gift Nifty today live over night or news related to stock or sector.

Stay updated on Aatmaj Healthcare share price targets today, tomorrow, next week, this Monday, next month, and projected five-year growth. Our detailed analysis provides insights into market trends, potential fluctuations, and investment strategies. Monitor our predictions to make informed decisions for your investment portfolio in Aatmaj Healthcare’s financial future.

Note:

1. The rationale taken for calculating Aatmaj Healthcare Share Price Target tomorrow’s range is expected to be between +5% and -5%, while today’s range is between +3% and -3%. Similarly, the range behind these calculating Aatmaj Healthcare Share Price Target Monday, next week, next month, and the next 5 years are expected to fall within a range of -8% to 111%, based on what the AI system has determined to be most likely. And that’s how these AI predictions with ChatGPT were made.

Uptrend: What Could Help Aatmaj Healthcare Share Price Target Grow

Here are the factors that could cause a rise in stock prices today, tomorrow, this week, this month, this year, and in the years to come. Let’s dive into what’s driving this growth!

Certainly! There are several positive factors that could potentially drive Aatmaj Healthcare’s share price upward by 2025. Here are a few key elements to consider:

-

Innovative Product Offerings: If Aatmaj Healthcare continues to invest in research and development, they could introduce new, innovative healthcare products or services. Think of a breakthrough treatment for a common ailment or a new health technology that improves patient outcomes. Such advancements often attract investor interest, boosting share prices.

-

Expansion into New Markets: Expanding operations into emerging markets or new geographical regions can significantly increase revenue streams. For instance, if Aatmaj decides to enter markets in Southeast Asia or Africa, they could tap into a large customer base, driving growth and positively impacting the share price.

-

Strategic Partnerships and Collaborations: Forming alliances with other healthcare companies or technology firms can enhance Aatmaj’s competitive edge. For instance, a partnership with a tech company for digital health solutions could improve service delivery and attract new customers, leading to a higher valuation.

-

Strong Financial Performance: Consistent revenue growth, profitability, and cost management can instill confidence in investors. If Aatmaj reports strong quarterly earnings and shows effective cost containment strategies, it may lead to an upward trend in the share price.

-

Increased Demand for Healthcare Services: As the global population ages and healthcare needs grow, demand for healthcare services is expected to rise. If Aatmaj can position itself as a leader in a specialty area, they may benefit significantly from this trend, impacting their stock performance positively.

-

Government Policies and Support: Favorable regulations and government initiatives aimed at improving healthcare access and affordability can create a conducive environment for Aatmaj to thrive. For example, increased healthcare funding can lead to more business opportunities, positively influencing share prices.

- Positive Public Perception: Building a strong brand reputation through quality services and effective community outreach can resonate with consumers and investors alike. If Aatmaj is seen as a trustworthy healthcare provider, this could enhance investor interest and support a higher share price.

By focusing on these factors, Aatmaj Healthcare has the potential to experience significant growth, driving its share price higher by 2025. The future looks promising as they navigate the evolving landscape of the healthcare industry!

Down Trend: What’s Contributing to the fall in Aatmaj Healthcare Share Price Target

Here are the factors that could lead to a decline in the company’s share price today, tomorrow, this week, this month, this year, and in the years to come. Let’s take a closer look at what’s driving this potential fall.

When considering the potential risks or challenges that might hold Aatmaj Healthcare’s share price target back by 2025, here are some key points to keep in mind:

-

Market Competition: The healthcare sector is highly competitive. If Aatmaj Healthcare does not keep up with competitors in terms of new technologies, services, or pricing, it might lose market share, which could negatively impact its stock price.

-

Regulatory Changes: Healthcare companies must comply with strict regulations. Changes in government policies, laws, or healthcare standards can create challenges or additional costs for the company, which may affect profitability and investor confidence.

-

Economic Factors: Economic downturns or changes in consumer spending habits can impact the demand for healthcare services. If fewer people can afford or choose to seek care, it could hurt Aatmaj’s revenue and stock performance.

-

Operational Challenges: Issues such as supply chain disruptions, staffing shortages, or high operational costs can affect the company’s ability to provide services efficiently. These challenges can lead to decreased profitability, which might deter investors.

-

Technological Risks: The healthcare industry is increasingly reliant on technology. If Aatmaj does not invest adequately in new technologies or fails to adapt to changes (like telehealth), it may fall behind, affecting its competitiveness and, consequently, its share price.

-

Public Perception and Trust: Trust is crucial in healthcare. Any negative events, such as medical errors or scandals, can damage the company’s reputation and lead to a decline in customer confidence, which may impact revenues and stock value.

- Global Health Crises: Events like pandemics can disrupt healthcare operations and shift demand for certain services. While some companies may benefit, others might struggle, and the uncertainty can lead to volatility in share prices.

By being aware of these risks, investors can make more informed decisions regarding Aatmaj Healthcare’s potential performance in 2025.

Will Aatmaj Healthcare Share Price Target go up?

The potential for Aatmaj Healthcare’s share price to rise hinges on market trends, company performance, and industry developments. Investors should keep an eye on upcoming earnings reports, regulatory changes, and overall economic conditions that can influence the stock. A strong pipeline and positive news could contribute to a bullish outlook.

Why is the Aatmaj Healthcare Share Price Target falling?

Aatmaj Healthcare’s share price target may be declining due to various factors such as disappointing earnings reports, negative market sentiment, or external economic pressures. Additionally, any regulatory hurdles or increased competition in the healthcare sector can deter investor confidence and lead to a reassessment of the company’s future growth potential.

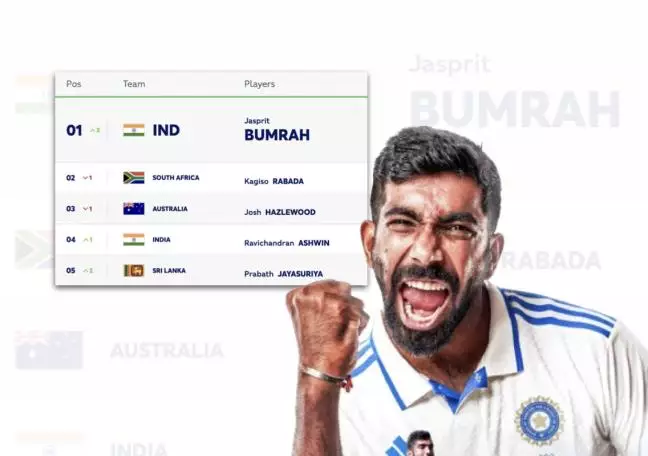

Bonus for Sports Lovers!

For all cricket enthusiasts, KhelGujarat.org offers a fantastic guide for watching live cricket streaming online. Don’t miss out on the action! You can catch all the thrilling matches for free on servers like Touchcric Live and Mobilecric Live. Enjoy every ball, wicket, and six from the comfort of your home!

Aatmaj Healthcare Share Price Target

When we talk about investing in stocks, it’s really important to keep an eye on their price targets. This guide digs into the Aatmaj Healthcare Share Price Target for 2025, helping both kids and adults understand what to watch out for. Remember, we feel that understanding the market can be both fun and informative, especially with our 7+ years of experience in the stock market since 2017.

Understanding Aatmaj Healthcare

Aatmaj Healthcare is making a name for itself in the healthcare sector. Since healthcare affects us all, companies in this field often attract interest from investors like you. They could be working on innovative treatments or improving patient care, which adds to their value. If you’re curious about how their share price can affect your investment, you’re in the right place!

Factors Influencing Aatmaj Healthcare’s Share Price

Several elements can impact Aatmaj Healthcare’s share price. For example, advancements in healthcare technology, government policies, and the overall economy can all play a role. If they launch a new healthcare product that captures a lot of interest, their shares could rise quickly! Conversely, if regulations aren’t favorable, it could impact their price negatively. We always recommend keeping an eye on portals like Moneycontrol, MunafaSutra, and Motilal Oswal for the latest updates.

Aatmaj Healthcare Share Price Target for 2025

Let’s get to the heart of the matter: What’s the price target for Aatmaj Healthcare in 2025? Based on market predictions and trends, analysts are optimistic about their growth. In our view, a reasonable target could range from a significant increase compared to their current price. But remember, this isn’t certain. Just like playing a video game, you can’t predict every move! It’s crucial to monitor their performance consistently and adjust your strategy as needed.

Buying and Selling Aatmaj Healthcare Shares

If you decide Aatmaj Healthcare seems like a good investment, you can buy and sell shares through platforms like Zerodha, Upstox, Angel One, or Groww. It’s super simple! But before diving in, make sure you do your own research. Understanding what you’re investing in reduces risks and helps you make better choices.

Conclusion: Making Informed Decisions

With so many factors at play, shared knowledge can help you decide whether to invest in Aatmaj Healthcare. We’ve shared our insights, but it’s essential to keep learning and stay updated. Remember, we do not provide trading tips or recommendations, and always do your own research before investing. So, whether you’re just starting or you have experience, keeping an eye on the stock market and understanding trends can be a rewarding experience for everyone! Happy investing!

We’d love to hear your thoughts if you enjoyed reading our article on Aatmaj Healthcare Share Price Target Tomorrow, 2025, 2030, then check out more such amazing updates at our Stock Market Skills home page and get big multi-baggers.